The Heckscher-Ohlin Model and Its Application in International Trade

Introduction to the Heckscher-Ohlin Model

The Heckscher-Ohlin Model, developed by Swedish economists Eli Heckscher and Bertil Ohlin—among the founding fathers of international trade—represents a significant advancement in the economic theory of international trade. Unlike the Ricardian model, which focuses on comparative advantages derived from technological differences between countries, the Heckscher-Ohlin Model emphasizes production factors such as capital and labor to explain trade patterns among nations.

According to this model, countries export goods that intensively use the abundant and inexpensive production factors in their economies, while they import goods that require scarce and expensive factors. For example, a country with an abundance of capital will export capital-intensive products and import goods that require a larger labor input.

The Heckscher-Ohlin theory is built upon two fundamental theorems: the Heckscher-Ohlin theorem and the factor price equalization theorem. The first states that a country will export goods that use its abundant factors intensively and, consequently, import goods that require scarce factors. The second theorem suggests that international trade tends to equalize production factor prices among countries, reducing economic disparities.

Differences Between the Heckscher-Ohlin Model and Other Trade Models

One of the main differences between the Heckscher-Ohlin Model and other international trade models is its focus on production factor endowments rather than technological differences. This model offers a more detailed and comprehensive perspective on why global trade occurs, highlighting the importance of capital and labor in the global economy.

With globalization and increasing economic interdependence, the Heckscher-Ohlin Model remains a valuable tool for analyzing the effects of trade agreements and economic policies. Its relevance in contemporary international trade lies in its ability to explain how differences in production factor endowments influence trade flows and the economic structure of nations.

Comparative Advantage Theory and the Heckscher-Ohlin Model

The theory of comparative advantage, proposed by David Ricardo in the 19th century, states that countries should specialize in producing goods in which they have a comparative advantage—that is, goods they can produce more efficiently compared to other nations. This theory revolutionized the understanding of international trade by demonstrating that even countries without an absolute advantage can benefit from trade.

The Heckscher-Ohlin Model, developed by Eli Heckscher and Bertil Ohlin, expands on this theory by introducing the concept of production factor endowments. According to this model, a country will export goods whose production requires an intensive use of the factors it possesses in abundance and, conversely, import goods whose production demands factors in which it is relatively less endowed. This approach provides a more detailed explanation of the observed international trade patterns.

A Practical Example

For instance, a country abundant in capital but with limited labor—such as Germany—will tend to specialize in producing capital-intensive goods like machinery and vehicles. In contrast, a country with an abundance of labor and scarce capital, such as Bangladesh, will specialize in producing labor-intensive goods like textiles and garments. Through trade agreements, these countries can exchange products in a way that allows both to benefit from globalization and international trade.

The Heckscher-Ohlin Model can also be observed in the relationship between the United States and Mexico. The United States, with its relatively high capital endowment, exports goods such as technology and chemicals to Mexico, while Mexico, with its abundant labor force, exports agricultural products and light manufactured goods to the United States. This exchange not only improves economic efficiency in both countries but also strengthens economic integration and international cooperation.

In essence, the Heckscher-Ohlin Model provides a robust and detailed framework for understanding global trade flows, complementing the theory of comparative advantage and offering a more comprehensive perspective on international economics.

Production Factors and Their Distribution

The Heckscher-Ohlin Model, a fundamental economic theory in international trade, is based on the differential distribution of production factors—primarily capital and labor—among countries. This model postulates that nations will export goods that intensively use the production factors in which they are abundant and, in turn, import goods that require factors that are scarce in their economy.

For example, a country with an abundance of capital and a scarcity of labor will tend to specialize in producing and exporting capital-intensive goods. Conversely, a country with a plentiful labor force but limited capital will focus on labor-intensive products. This dynamic partially explains why economies like Germany, which is rich in capital, export advanced machinery, while countries with large workforces, such as Bangladesh, specialize in textile production.

Recent studies have confirmed the validity of the Heckscher-Ohlin Model. An analysis of trade between the United States and China revealed that the export of technological products and machinery from the United States is due to its abundance of capital and advanced technological skills. On the other hand, China exports low-cost manufactured goods, reflecting its comparative advantage in abundant and inexpensive labor.

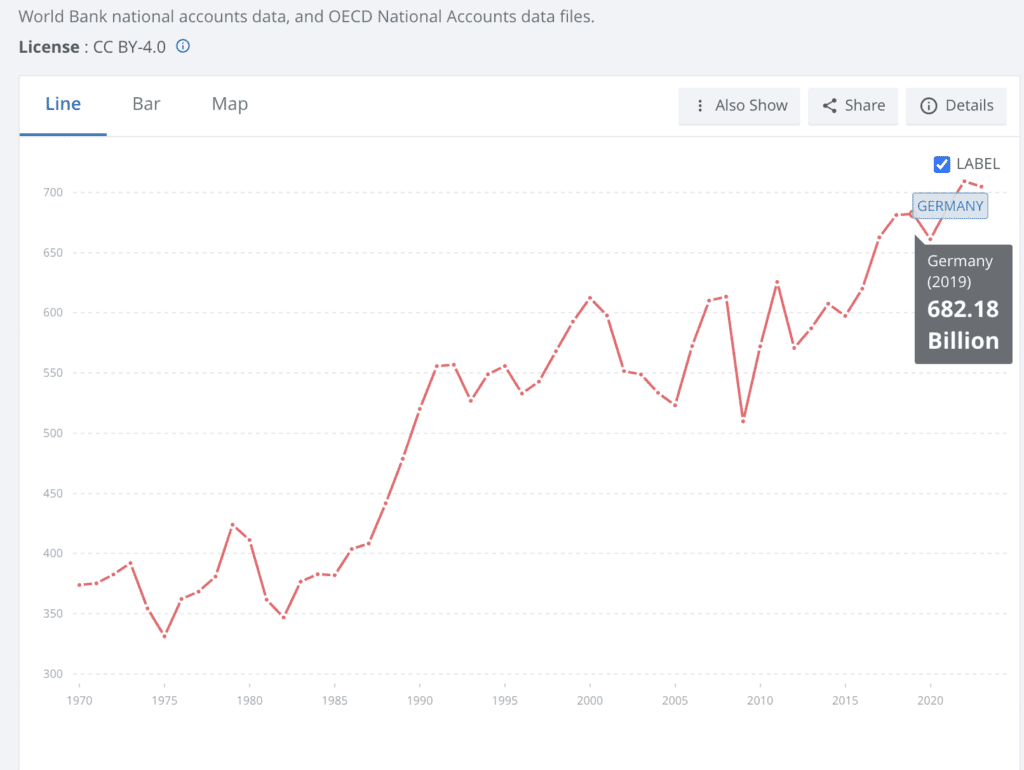

Statistical evidence also supports this theory.

According to World Bank data, in 2019, Germany’s per capita capital was significantly above the global average, and its skilled workforce exhibited high productivity rates. In contrast, developing countries with large populations, such as India, showed an inverse relationship—with lower per capita capital but a large active labor force.

These trade patterns, influenced by the distribution of production factors, underscore the importance of the Heckscher-Ohlin theory in understanding economic globalization. Trade agreements also reflect these principles, enabling countries to maximize their comparative advantages and promote more efficient and equitable international trade.

Empirical Evidence of the Heckscher-Ohlin Model

The Heckscher-Ohlin (H-O) Model has been subject to numerous empirical tests since its formulation, aiming to validate its predictions within the context of international trade. Based on production factor endowments such as capital and labor, the model suggests that countries will export goods whose production intensively uses the factors in which they are most abundantly endowed. To assess the accuracy of this economic theory, various studies have employed different methodologies and economic data.

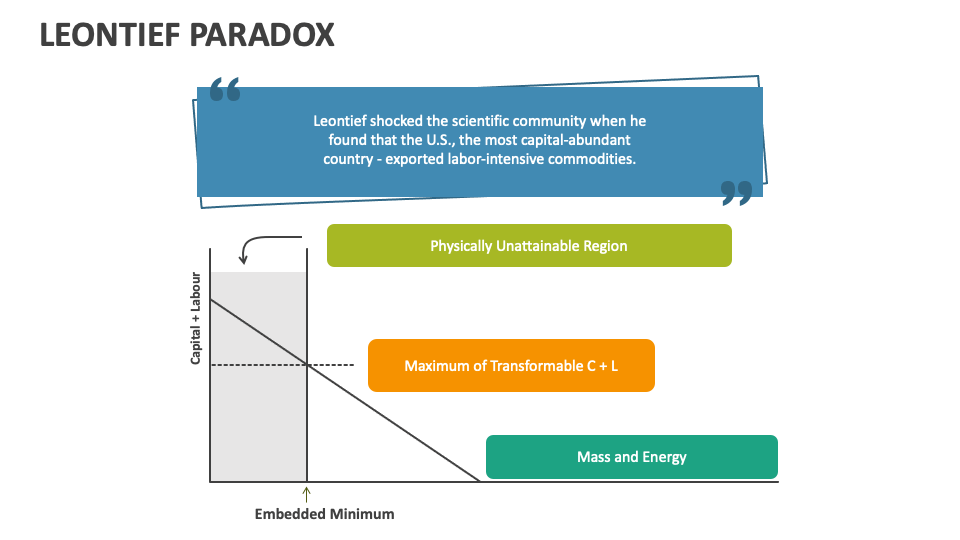

The Leontief paradox

One of the most notable studies is Wassily Leontief’s work, known as the «Leontief Paradox.» Leontief analyzed data from the post-World War II U.S. economy and found that, contrary to the predictions of the H-O Model, the United States exported goods that were less capital-intensive and more labor-intensive, despite being a capital-rich country. This finding sparked significant debate and led to a reevaluation of the model’s basic assumptions.

More recent studies have employed advanced econometric techniques and large datasets to analyze the validity of the H-O Model. For instance, analyses of bilateral trade data among multiple countries generally show that the model’s predictions hold: countries tend to export goods that require the production factors they possess in abundance.

Furthermore, the use of computational models and simulations has enhanced our understanding of how trade agreements influence the structure of exports and imports, in some cases supporting the claims of the Heckscher-Ohlin Model. However, globalization and economic integration have added layers of complexity that sometimes challenge the model’s simpler predictions.

Criticisms and Limitations of the Model

While the Heckscher-Ohlin Model has been a fundamental tool in explaining international trade patterns, it has not been without criticisms and limitations. One major criticism is its reliance on simplifying assumptions, such as perfect factor mobility within a country and the absence of trade frictions. These assumptions do not always reflect the complexity of the global economy, where tariffs, government regulations, and other factors can influence trade.

Additionally, the model assumes that production technologies are identical across countries, which is not always the case. Technological disparities can play a crucial role in determining trade patterns, meaning that countries with advanced technologies may export products that do not necessarily align with their production factor endowments. This phenomenon has been observed in various emerging and developed economies, questioning the universal applicability of the model.

Another significant limitation is the model’s inability to account for intra-industry trade—that is, the exchange of similar products between countries. In reality, many economies engage in significant trade in highly differentiated products within the same industry, which the Heckscher-Ohlin Model does not adequately explain. This type of trade is common in industries such as automotive and electronics, where globalization has fostered complex value chains.

Economists like Paul Krugman have argued that while the theory of comparative advantage (of which the Heckscher-Ohlin Model is an extension) is valuable, it needs to be complemented by other approaches to better capture the dynamics of international trade. Factors such as trade agreements, foreign direct investment, and market integration also need to be considered for a more holistic understanding of the global economy.

Application of the Heckscher-Ohlin Model in Trade Policies

The Heckscher-Ohlin Model has played a fundamental role in shaping global trade policies. By focusing on comparative advantages based on production factor endowments, this economic model has been an essential tool for governments and international organizations. It provides a theoretical foundation for understanding how differences in resource endowments affect international trade, enabling the design of strategies that maximize each country’s competitive advantages.

A Practical Example in Trade Policy

A practical application of the Heckscher-Ohlin Model can be seen in the implementation of bilateral and multilateral trade agreements. These agreements aim to reduce tariff and non-tariff barriers, thus facilitating the exchange of goods and services between countries with differing factor endowments. For example, the North American Free Trade Agreement (NAFTA) between the United States, Canada, and Mexico allowed each country to specialize in the production of goods for which it has a comparative advantage, thereby optimizing regional trade.

Moreover, the Heckscher-Ohlin Model has been used to justify trade liberalization policies. The theory suggests that opening markets can lead to a more efficient allocation of resources on a global scale, which in turn can foster economic growth. However, it is important to note that the effectiveness of these policies can vary depending on the economic and political context of each country. While some nations have experienced significant growth following liberalization, others have faced challenges such as deindustrialization and increased inequality.

Impact of International Trade on Wealth Distribution

Under the lens of the Heckscher-Ohlin Model, international trade has profound implications for wealth distribution both within countries and globally. According to this economic theory, nations tend to export goods that intensively use the production factors they have in abundance, and import goods that require scarce factors in their economy. This process of specialization and trade can, in turn, affect the wealth of nations and their citizens in various ways.

Intra-national Effects

From a domestic perspective, international trade can alter a country’s income structure. For example, in economies where capital is abundant and labor is scarce, exposure to international trade may benefit capital owners while workers might see their incomes stagnate or even decline. This phenomenon is observed in the rising income inequality in some developed economies, where globalization has favored certain sectors over others.

International Implications

On an international level, trade based on the Heckscher-Ohlin Model can help reduce income disparities between countries. Developing economies, which typically have an abundance of labor, can experience significant economic growth by specializing in labor-intensive industries and exporting these products to labor-scarce markets. This process may facilitate a more equitable distribution of global wealth, although it is not without challenges—such as fluctuations in export prices and dependence on external markets.

It is crucial to note, however, that the benefits of international trade are not evenly distributed. Factors such as institutional quality, infrastructure, and public policies can influence a country’s ability to harness the opportunities offered by global trade. Moreover, trade agreements play a significant role in determining the conditions under which international exchanges occur, directly impacting wealth distribution.

Case Studies: Real-World Applications of the Heckscher-Ohlin Model

he Heckscher-Ohlin Model has been instrumental in understanding international trade patterns and wealth distribution among countries. Below are some case studies that illustrate how this economic theory manifests in practice across different contexts and industrial sectors:

United States and China

The United States, with its abundance of capital and advanced technology, specializes in exporting high-tech goods and machinery. In contrast, China, endowed with a vast labor force, focuses on manufacturing and textiles. This trade pattern aligns with the Heckscher-Ohlin Model’s predictions that countries will export goods that intensively use their abundant production factors.

Australia and Japan

In the resource and technology sectors, Australia—rich in natural resources such as minerals and agricultural products—exports these commodities to Japan. Meanwhile, Japan, with its high technological capabilities and capital, exports electronics and vehicles to Australia. This exchange demonstrates how differences in production factor endowments influence comparative advantages and trade patterns.

Germany and Eastern European Countries

In Europe, trade between Germany and Eastern European nations also illustrates the Heckscher-Ohlin Model. Germany, with its advanced automotive industry and machinery, exports these goods to countries like Poland and the Czech Republic. In return, these nations export more basic manufactured products and industrial components to Germany. This trade flow is based on the differences in capital and labor endowments between these regions.

These examples demonstrate how trade policies and business decisions align with the predictions of the Heckscher-Ohlin Model. Understanding these dynamics is crucial for developing trade strategies and economic policies that maximize the benefits of international trade in an increasingly globalized world.