Introduction

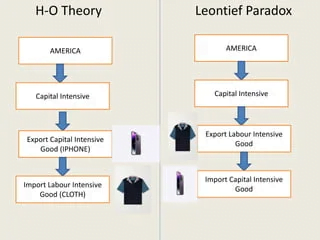

The Leontief Paradox, discovered by economist Wassily Leontief in the 1950s, posed a significant challenge to classical international trade theory. According to this theory, countries tend to export goods that intensively use their most abundant production factors and import those that require relatively scarce factors. However, Leontief’s analysis revealed a surprising pattern in the United States—a country traditionally viewed as capital-intensive.

Leontief employed the input-output analysis method he developed to study the structure of U.S. trade. His results showed that the United States was exporting labor-intensive goods and importing capital-intensive goods, which directly contradicted the expectations based on the Heckscher-Ohlin model. This unexpected finding led to a profound reconsideration of the international trade theories of that era.

The Leontief Paradox not only challenged the foundational assumptions of prevailing trade theory but also paved new paths for research and academic debate. Economists began exploring alternative explanations for this phenomenon, considering factors such as technological differences, consumption preferences, and trade policies. Furthermore, the paradox spurred the development of more complex models that incorporated additional variables to provide a more precise and comprehensive understanding of international trade patterns.

Today, the Leontief Paradox remains a relevant and intriguing subject in the study of international economics. Over the years, it has served as a reminder of the importance of continuously questioning and revising economic theories in light of new evidence and analytical methods. Subsequent research has deepened our understanding of global trade dynamics, even though the paradox itself has not been fully resolved, maintaining its prominence in contemporary academic debates.

Origin and Discovery of the Leontief Paradox

Wassily Leontief, a Russian-American economist, conducted his innovative study on international trade in the 1950s. Born in 1906 in Munich, Germany, and educated at the University of Berlin, Leontief moved to the United States in 1931, where he built his academic career at Harvard University. His interest in economic models and production structures led him to examine the dynamics of international trade, specifically focusing on the theories established by the Heckscher-Ohlin model.

Using the input-output table—a sophisticated analytical tool he had perfected—Leontief set out to empirically test the predictions of the Heckscher-Ohlin model. This theoretical framework posited that countries export goods whose production uses their abundant factors intensively, and import goods that require the scarce factors within their economy.

For his study, Leontief analyzed U.S. export and import data from 1947. According to the Heckscher-Ohlin model, the expectation was that the United States—a country rich in capital—would export capital-intensive goods and import labor-intensive goods. Instead, Leontief discovered that the United States was exporting labor-intensive goods and importing capital-intensive ones.

This finding, now known as the Leontief Paradox, came as a major surprise to the economic community. Leontief’s conclusions sparked extensive debate and led to a critical reassessment of existing international trade theories. The paradox not only questioned the basic assumptions of the Heckscher-Ohlin model but also spurred new research and theoretical developments aimed at explaining the complex realities of global trade.

Impact on International Trade Theories

The Leontief Paradox had a significant impact on traditional international trade theories, particularly the Heckscher-Ohlin model. This model predicted that countries would export products that intensively used their abundant factors—such as capital or labor. However, Leontief’s analysis of the U.S. economy revealed the opposite: a capital-rich country exporting labor-intensive goods while importing capital-intensive ones. This observation surprised the economic community and raised doubts about the validity of the Heckscher-Ohlin framework.

To address the paradox, economists proposed several alternative explanations. One prominent hypothesis is that differences in technology and productivity among countries play a crucial role in shaping international trade. According to this perspective, countries with advanced technologies and higher productivity in certain sectors may export products that do not necessarily align with their abundant factors. For example, the superior productivity in U.S. labor-intensive sectors could explain Leontief’s unexpected findings.

Another explanation focuses on the nature and quality of production factors. The exported goods from the United States might have required highly qualified human capital—more so than simply unskilled labor—which would alter the interpretation of what constitutes an “abundant” factor in trade analysis.

The academic debate around the Leontief Paradox remains active. While some economists criticize Leontief’s methodology and data as potentially non-generalizable, others argue that the Heckscher-Ohlin model must be adjusted to include additional variables such as trade barriers and government policies, which also influence trade patterns.

Ultimately, the Leontief Paradox has enriched the field of international economics by stimulating new lines of research and debate. It has led economists to continuously refine existing theories, underscoring the complexity of global trade and the need for more comprehensive models.

Contemporary relevance

In recent decades, the Leontief Paradox has been re-examined using more current data and advanced analytical techniques. Numerous studies have shown that Leontief’s observations remain relevant in today’s international trade context. Globalization and technological advancements have drastically transformed traditional trade patterns, leading to a reconfiguration of global supply chains and an intensification of outsourcing.

One key factor in the re-evaluation of the Leontief Paradox is the impact of global supply chains. Modern economies are not solely engaged in trading finished products; companies now participate in intricate global production networks, exporting components and intermediate services rather than complete products. This trend challenges the simplistic idea that countries export goods intensive in locally abundant factors.

Moreover, the rise of outsourcing has played a critical role in shaping contemporary trade patterns. Multinational corporations have leveraged the comparative advantages of different countries to optimize production costs, leading to a marked increase in the trade of services and intermediate goods. This phenomenon reinforces the notion that trade patterns do not always conform to traditional expectations based solely on factor endowments.

Technological progress, including digitalization and automation, has also reshaped the structure of international trade. These advancements have diminished the reliance on certain production factors, allowing countries to compete in technology-intensive industries regardless of their natural factor endowments. Consequently, export diversification has increased, making Leontief’s observations even more applicable today.

Applications and Case Studies of the Paradox

The Leontief Paradox has been a subject of great interest in international trade analysis, especially within advanced economies. One prominent example is the trade relationship between the United States and China. Despite being a highly developed economy, the United States exports a substantial volume of goods that are intensive in skilled labor—such as software, financial services, and pharmaceuticals—while importing capital-intensive products like electronic devices and heavy machinery from China.

A recent study by the World Trade Organization (WTO) revealed that in 2022, the United States exported products valued at $1.7 trillion, a significant portion of which were high value-added services. In contrast, imports of manufactured goods—particularly electronics and machinery—totaled $2.6 trillion. These figures not only support Leontief’s observations but also highlight the U.S. specialization in knowledge- and technology-intensive sectors.

Another relevant example is the trade between Germany and other European Union countries. Germany, renowned for its strong automotive and machinery industries, exports a large share of capital-intensive goods. However, recent studies have indicated that Germany also exports a significant quantity of goods intensive in skilled labor, such as chemicals and pharmaceuticals. This suggests that the Leontief Paradox may be present even in highly industrialized economies.

In Latin America, Brazil presents an interesting case. Traditionally viewed as an exporter of labor-intensive products like agricultural goods and textiles, Brazil has, in recent decades, increased its exports of capital-intensive products such as airplanes and heavy machinery. This shift in export patterns can be seen as evidence supporting the Leontief Paradox, demonstrating that even developing countries can export goods that require significant capital investment.

In Asia, Japan serves as another notable example. Although Japan is a country with considerable capital resources, it exports a significant volume of capital-intensive products, including electronics and automobiles. Simultaneously, Japan exports goods that require highly skilled labor, such as electronic components and high-tech products. This trade pattern is consistent with the Leontief Paradox and underscores Japan’s specialization in high-tech sectors.

These case studies illustrate that the Leontief Paradox continues to be relevant in the analysis of contemporary international trade. Global trade dynamics persistently challenge traditional theories, emphasizing the importance of factors such as technology, specialization, and trade policies in shaping trade patterns.

A Case Contrary to the Leontief Paradox

Context of Canada

Canada, as an open economy, relies heavily on international trade, which contributes approximately 30% to its GDP. Known as one of the world’s largest suppliers of agricultural products, Canada presented a unique opportunity for research—until now, no studies had investigated the factor intensities of its agricultural products, prompting the current study.

Methodology

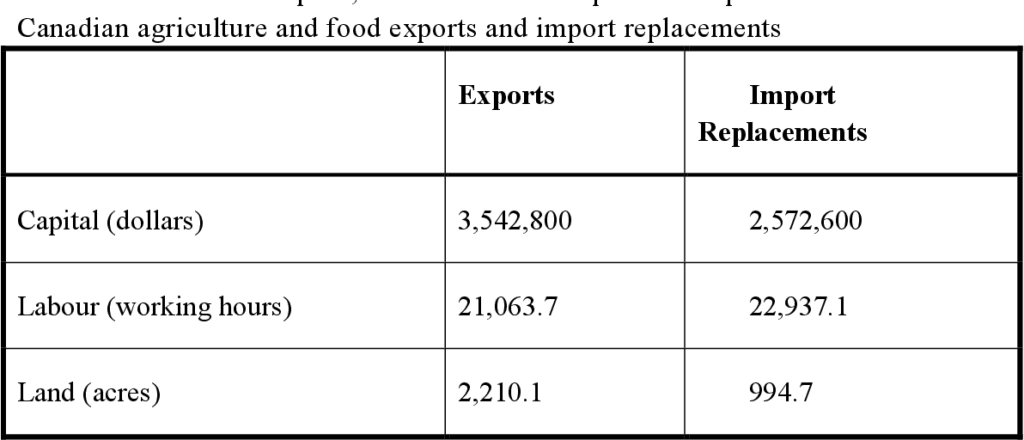

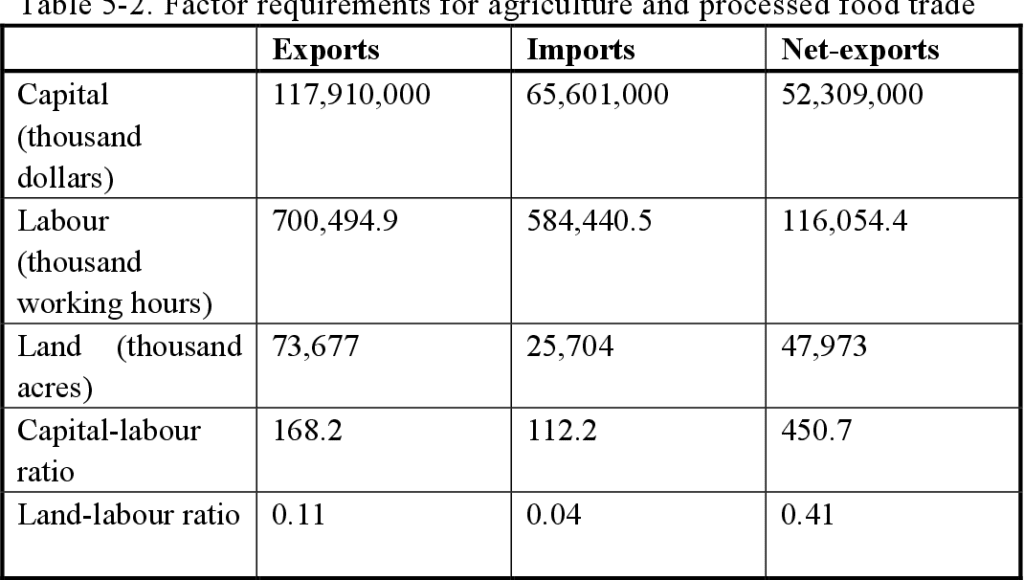

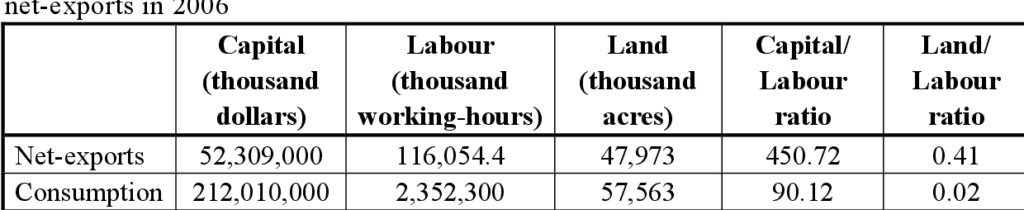

The study employed Canada’s 2006 input-output table to examine whether the Leontief Paradox applied to agricultural and processed food trade. Factor intensities in exports and import substitutes for agricultural and processed food products were estimated using both the Leontief and Leamer approaches. The Leamer approach provided additional insights into factor endowments, allowing a direct comparison between factor endowments and their intensities in Canadian trade.

In addition to capital and labor, the study incorporated land as a factor, given the importance of natural resources in Canadian trade. The agricultural and processed food sectors were further detailed in the input-output model to gain a better understanding of the trade structure for these products.

Conclusions

Contrary to Leontief’s findings in the United States, the study found no evidence of the Leontief Paradox in Canada’s agricultural and processed food trade. Canada was found to export capital-intensive products and import labor-intensive ones. Moreover, while Canada exported products that were both land- and capital-intensive, land was relatively more intensive in exports compared to capital.

References:

- “Leontief Paradox and Its Impact on Trade Theory,” Journal of Economic Perspectives, 2001.

- “Technological Differences and the Leontief Paradox,” International Economic Review, 1998.

- “Globalization, Outsourcing, and the Leontief Paradox,” World Trade Organization Report, 2022.

- “Revisiting the Leontief Paradox: The Role of Factor Quality,” Economic Inquiry, 2015.

- “Input-Output Analysis and Trade Patterns: A Study of Advanced Economies,” European Economic Review, 2010.

- Tingting, W., Mukhopadhyay, K., & Thomassin, P.J. (2012). An Investigation of the Leontief Paradox using Canadian Agriculture and Food Trade : An Input-Output Approach.