The Founding Fathers of International Trade – Part 2

The Founding Fathers of International Trade, explained and summarized for everyone

We will delve into other pioneers of international trade, but first, check out our article to learn more about Adam Smith and David Ricardo.

The Founding Fathers of International Trade

As we have already examined some of the founding figures—namely Adam Smith and David Ricardo—this time we will discuss many more in a didactic and concise manner. We will cover renowned names such as the duo Eli Heckscher and Bertil Ohlin, Thomas Malthus, John Stuart Mill, Hobbes, Hume, and John Locke. These thinkers include advocates of liberal economic policies (like Locke, Malthus, and Mill) alongside classical economists like Adam Smith and David Ricardo, while Heckscher and Ohlin represent a more laissez-faire approach, influenced by Ricardo and emerging in the 20th century.

Eli Heckscher: The Founder of the Factor Proportions Theory

A Swedish Visionary

Eli Filip Heckscher, born in 1879 in Stockholm, Sweden, was an economist and economic historian who left a lasting legacy. Educated at Uppsala University and later at Stockholm University, Heckscher immersed himself in studying the economic forces that drive international trade. His passion for economic history enabled him to develop a unique and profound perspective on the dynamics of global trade.

The Theory of Factor Proportions (Later Known as the Heckscher-Ohlin Model)

In 1919, Heckscher presented his theory, arguing that international trade is based on differences in production factor endowments between countries. According to his theory, nations export goods that require the factors they have in abundance and import goods that require scarce factors. For example, a country with vast expanses of fertile land naturally specializes in agricultural exports, while a nation rich in industrial capital will focus on manufacturing exports.

Impact and Legacy

Heckscher’s groundbreaking idea provided a fundamental basis for understanding global trade patterns and has influenced how countries shape their trade policies. His theory remains a cornerstone in international economics, helping us predict the flow of goods in an increasingly globalized world.

Bertil Ohlin: Expanding the Horizons of Trade Theory

The Innovative Disciple

Born in 1899, Bertil Ohlin was a Swedish economist who significantly expanded on his mentor Heckscher’s ideas. After studying at Lund University and Stockholm University, Ohlin became a professor at the Stockholm School of Economics. In 1977, he was awarded the Nobel Prize in Economics, recognizing his fundamental contributions to economic theory.

Development and Formalization

In 1933, Ohlin published Interregional and International Trade, formalizing and expanding upon Heckscher’s concepts. He introduced crucial ideas such as the mobility of production factors and technological differences between countries. The Heckscher-Ohlin model, as it is known today, holds that differences in production factor endowments and the intensity with which these factors are used determine international trade patterns.

Modern Relevance

Ohlin’s theory not only explains trade between developed and developing countries but also provides the foundation for contemporary trade policies. In today’s world of global supply chains, understanding comparative advantages based on production factors is essential for both businesses and governments. For instance, the current trade war between the United States and China can be analyzed through this lens, as differences in capital and labor endowments influence each country’s trade strategy.

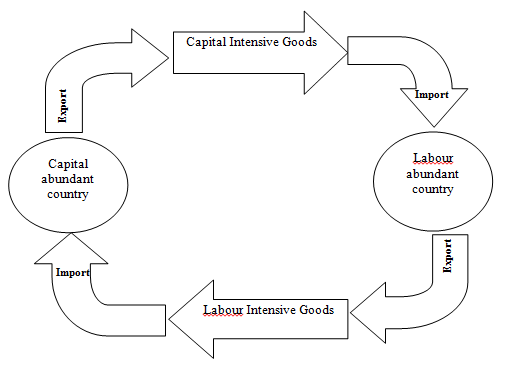

A Brief Introduction to the Heckscher-Ohlin Model

This model explains international trade patterns based on differences in production factor endowments between countries.

Key Points

- Basic Assumptions:

- Two countries, two goods, and two production factors (labor and capital).

- Constant and identical technology in both countries.

- Factor Endowments:

- Each country has a relative abundance of one production factor compared to the other.

- Factor Intensity:

- Goods are classified according to their intensity in the use of production factors (labor-intensive or capital-intensive).

- Trade Mechanism:

- Comparative Advantage: Countries specialize in producing and exporting goods that intensively use the factors they have in abundance.

- Trade Pattern:

- Export goods that are intensive in abundant factors and import goods that are intensive in scarce factors.

- Equilibrium:

- International trade adjusts the relative prices of goods and production factors, tending to equalize factor prices between countries.

Modern Relevance

- Globalization: Explains global supply chains and production localization.

- Trade Policy: Forms the basis for international trade agreements and policies.

- Income Distribution: Offers insight into economic inequality within countries as a function of international trade.

In a future article, we will explore this model in greater depth because it deserves a detailed explanation.

John Stuart Mill: A Multifaceted Intellectual

Life and Context

John Stuart Mill was born in 1806 in London, England, into an intellectual family. His father, James Mill, was a renowned economist and philosopher, greatly influencing John Stuart’s education. From an early age, Mill was trained in a variety of disciplines—including economics, philosophy, and politics—making him one of the most prominent intellectuals of his time.

Contributions to International Trade Theory

Mill was a strong advocate of free trade and expanded upon the ideas of his predecessors such as Adam Smith and David Ricardo. His major contributions to international trade theory focus on the Theory of Reciprocal Demand and the concept of Comparative Advantage.

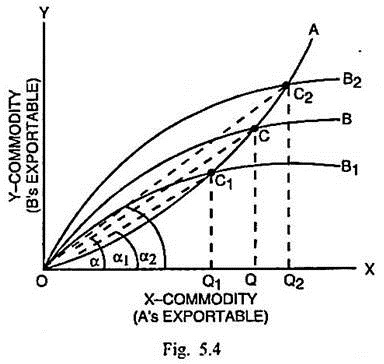

The Theory of Reciprocal Demand

Concept Explanation:

Mill’s theory of reciprocal demand explains how the terms of trade between two countries are determined in international trade. According to this theory, the relative price of the goods traded depends on the reciprocal demand for those goods. In other words, the export price of a good is determined by the quantity the exporting country is willing to supply and the quantity the importing country is willing to demand.

Example Illustration:

Imagine two countries, A and B. Country A produces wine while Country B produces textiles. According to Mill, the price of wine in terms of textiles will be determined by the demand for textiles in Country A and the demand for wine in Country B. If the demand for wine increases in Country B, the price of wine (in terms of textiles) will rise, incentivizing Country A to export more wine.

Thomas Malthus: Life and Context of a Classic

Brief Biography

Thomas Robert Malthus was born in 1766 in Surrey, England. An Anglican clergyman and scholar with a keen interest in economics and demography, he studied at Jesus College, Cambridge, and later became a professor of History and Political Economy at the East India Company College.

Historical Context

Malthus lived during the Industrial Revolution, a time of rapid economic and social change. His principal work, An Essay on the Principle of Population (1798), was written in response to the overly optimistic predictions of his contemporaries regarding unlimited economic progress.

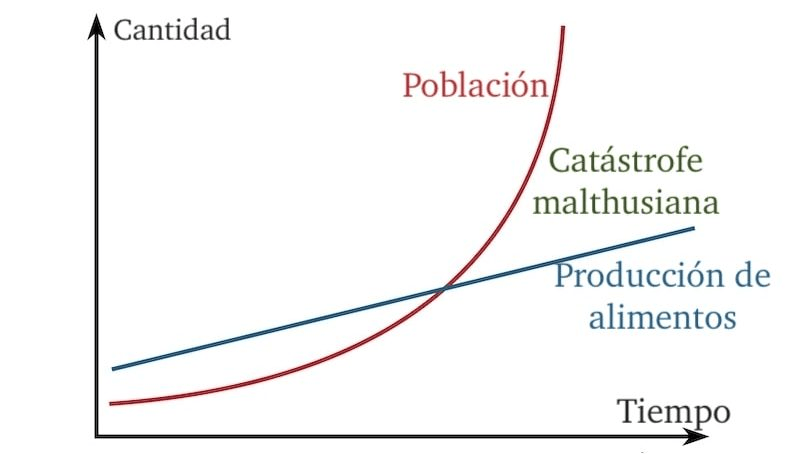

Contributions to International Trade

Population Theory and Its Impact on the Economy

Malthus’s most famous theory posits that population grows geometrically while resources (especially food) increase only arithmetically. This discrepancy, he argued, would inevitably lead to resource scarcity, resulting in cycles of hunger and poverty.

Implications for International Trade

Although Malthus did not focus solely on international trade, his ideas about resource scarcity have direct implications for global commerce. Countries facing shortages of food and other natural resources must rely on international trade to meet their needs, while nations with resource abundance enjoy a competitive edge.

Effective Demand

Malthus also introduced the concept of “effective demand,” referring to the capacity of consumers to purchase goods and services. This concept is critical for understanding production imbalances and trade dynamics. Insufficient effective demand can lead to overproduction and economic crises, impacting international trade flows.

Thomas Hobbes: The Social Contract and Economic Order

Overview

Thomas Hobbes (1588-1679) is best known for his work Leviathan (1651), in which he introduced the idea of the social contract. Although not primarily an economist, Hobbes’s concept of a strong, centralized state to prevent chaos and civil war is crucial for maintaining the stability necessary for international trade.

Contribution to International Trade

Hobbes argued that for trade to flourish, a strong central government must enforce laws and maintain order. This concept is mirrored in the need for international institutions and trade agreements that regulate and facilitate commerce among nations.

Contemporary Example

The World Trade Organization (WTO) exemplifies Hobbes’ influence. The WTO sets standards to ensure that trade between countries is fair and efficient, providing a structured, centralized framework akin to the state Hobbes envisioned.

David Hume: The Trade Balance and the Flow of Money

Overview

David Hume (1711-1776) was a Scottish philosopher and economist who made significant contributions to economic theory, notably with his essay Of the Balance of Trade (1752). Hume argued that international trade and the flow of money naturally balance themselves.

Contribution to International Trade

Hume introduced the idea that the flows of gold and silver between countries automatically adjust trade balances. If a country exports more than it imports, it will receive an influx of gold, which raises domestic prices and eventually reduces its exports. This “price-flow mechanism” is fundamental to understanding how economies achieve balance through trade.

Contemporary Example

Today, Hume’s theories are reflected in how currency markets operate. Fluctuations in exchange rates help balance trade between countries, ensuring that no nation maintains an excessive surplus or deficit for too long.

John Locke: Private Property and Natural Rights

Overview

John Locke (1632-1704) is one of the most influential philosophers in both political and economic theory. In his Second Treatise of Government (1689), Locke argued that private property and individual rights are fundamental to economic development.

Contribution to International Trade

Locke maintained that protecting private property and natural rights is essential for economic prosperity. His emphasis on individual rights and property laid the philosophical groundwork for free trade, enabling individuals and companies to exchange goods and services freely.

Contemporary Example

Locke’s defense of property rights and individual liberties remains a cornerstone of modern market economies. Free trade policies that promote competition and innovation are deeply rooted in the principles that Locke championed centuries ago.